Budget 2013: where is the money coming from, and where is it going?

While there was some speculation that today's announcement by the Chancellor would be a "dull budget", the contents of Mr Osborne's red box will still prove vitally important for individuals and families up and down the country.

But as commentators pick over the raft of policy announcements and economic forecasts that made up the Chancellor's speech, it can be easy to feel swamped by the vast sums involved. Here's our factsheet to help guide you through what these numbers really mean.

Budget numbers in context:

Full Fact looked at some of the economic background to today's announcement yesterday, as we factchecked David Cameron's claims on youth unemployment, deficit reduction and business creation.

Much of the pre-Budget speculation has focused on fuel and alcohol duties, as well as personal tax allowances.

But just how important are these to the Treasury?

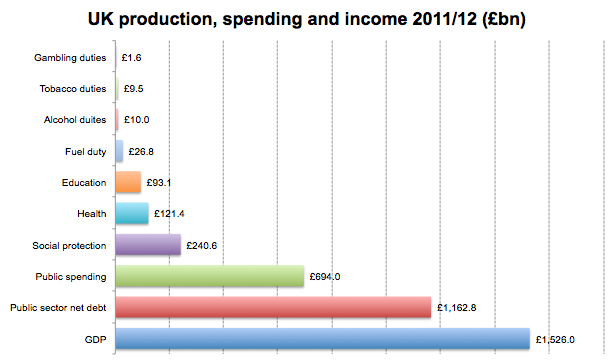

The table below shows how these duties compare to public spending, UK debt and GDP:

(Sources: HM Treasury public spending statistics February 2013, public sector finances January 2013, and HMRC tax receipts February 2013.)

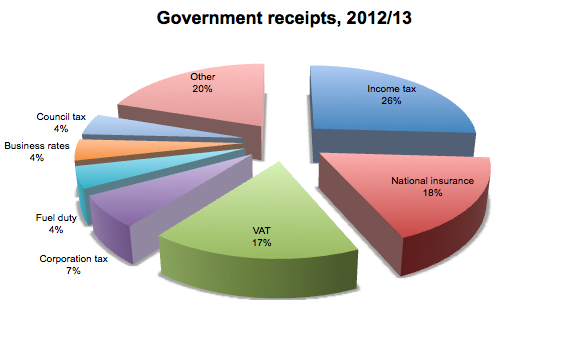

Where does the money come from?

The Government expects to receive nearly £594 billion in the 2012/13 financial year, the vast majority of which is from taxes.

Income tax represents the largest single source of revenue for the Treasury, bringing in over a quarter of all receipts (£154 billion). This, together with National Insurance (which was the subject of major reform in today's Budget) and VAT, represents over half of all the money brought in by the taxman.

(Source: HM Treasury public sector finances January 2013)

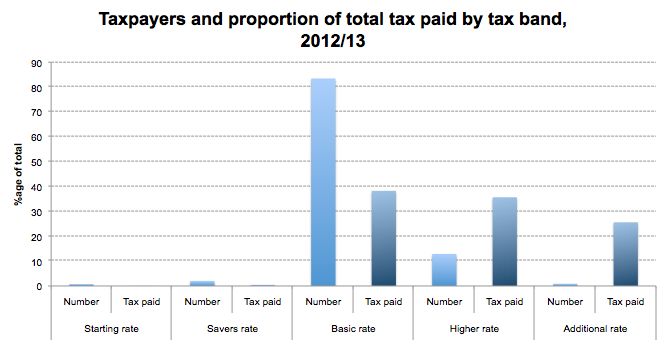

The Chancellor today claimed that he was on the side of working families in announcing that the tax-free threshold will be raised to £10,000. Labour Leader Ed Miliband responded by claiming that this was the very group hit hardest, and that more should be taken from millionaires. So who pays what in Income Tax?

As the chart below shows, while over 80% of taxpayers fall within the Basic Rate tax band (earning up to £34,370), this band represents just over a third of total receipts. While Additional Rate taxpayers (those earning over £150,000) accounted for less than 1% of all taxpayers, they produced over a quarter of all revenues.

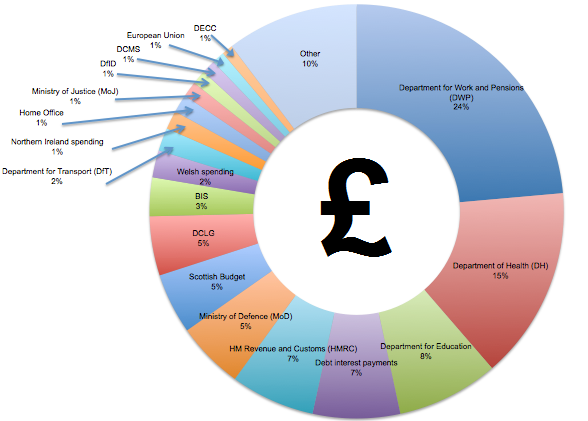

Where does the money go?

Public sector spending cost the Government £660.7 billion in the last financial year (2012-13), significantly more than it recouped through taxes. The remainder - the Budget deficit - needed to be covered through borrowing.

That has prompted George Osborne to ask Government Departments to find a further 2% in savings (apart from the health and schools budgets, which are protected). So what will this mean for departments, and the services they provide? Our chart below shows where the money currently goes: