Inflation catches up with wage growth

“[Christopher] says in the last five years my husband has had only a 1% increase in his wages, the cost of living has risen each year. We now have at least 15% less buying power than then.”

Jeremy Corbyn, 26 April 2017

We can’t speak for Christopher’s situation in particular, but we can put that experience in context.

There’s no one way to measure the cost of living, but a common one is to look at whether people’s wages are keeping pace with rising prices.

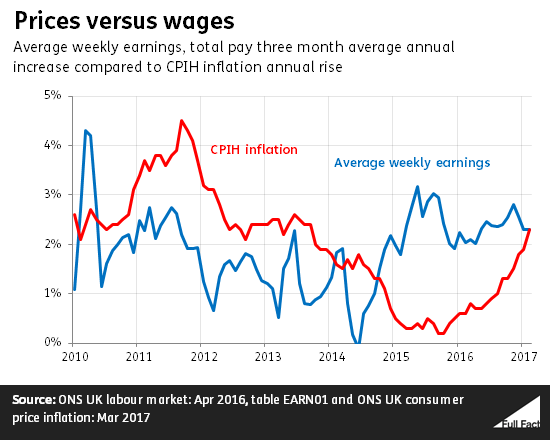

Since 2010, there have been two distinct chapters to this story. Inflation—as measured by the CPIH index—was higher than wage growth from 2010 to 2014, meaning the real value of people’s pay packets was falling.

But wages have been rising faster since then, and average wages are now roughly back to the level they would have been had they been flat all along.

The latest figures show that inflation has caught up again, which means that wages are now, on average, stagnating.

Honesty in public debate matters

You can help us take action – and get our regular free email

Averages only tell you so much

These figures are all very broad because they’re taking averages: the average weekly wage compared to an average ‘basket’ of goods a household might buy, to calculate inflation. That gives you the bigger picture, but doesn’t tell you very much about your own situation.

If, like Christopher, your pay has only been rising 1% a year, then the value of your wages has been falling since last September, because annual inflation has been higher.

Prices, as measured by official inflation figures, are nearly 14% higher now than they were in 2010. So, in a sense, that’s one benchmark to work out whether your wages have kept pace. A 1% annual rise wouldn’t be enough.

You’re also more likely to be feeling the pinch in the public sector. Public sector workers’ pay is currently rising at 1.4% a year, behind inflation at 2.3% and private sector workers at 2.5%.

Even then, it’s worth bearing in mind that not everyone experiences the same inflation. It depends ultimately on what you spend your money on.

This isn’t a direct measure of living standards

These figures don’t tell us whether people are, overall, better or worse off economically. They don’t take into account what’s happening to taxes and benefits, for example.

The Office for National Statistics does produce broader figures on economic well-being, for example, that try to capture people’s ‘take-home pay’, after these kinds of thing have been taken into account.

These figures generally show living standards slumped in the early years since 2010, as the economy struggled in the wake of the financial downturn in the late 2000s. But in the past few years, most measures have shown increases again, in line with relatively low inflation.