Economy introductions: income tax and who pays it

Last year, the government collected £168 billion in income tax. That’s about a third of total taxes collected.

Honesty in public debate matters

You can help us take action – and get our regular free email

Who Pays What?

About 30 million people in the UK pay income tax, but who pays what overall?

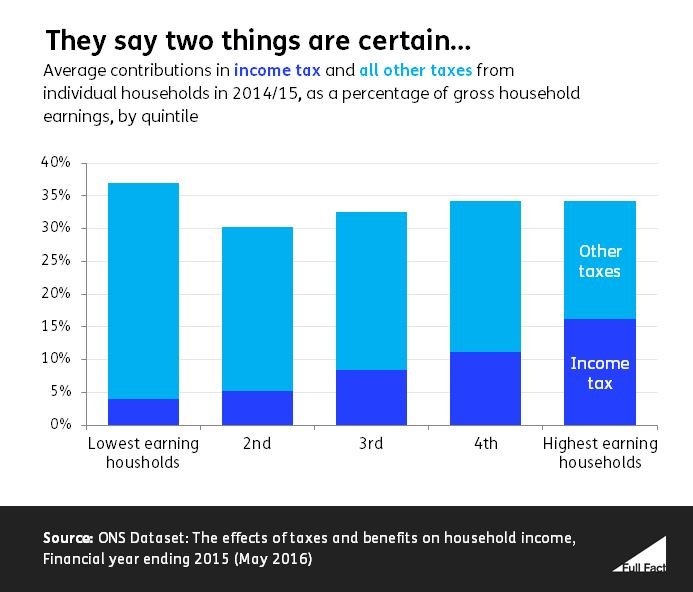

Households with lower incomes end up paying a larger proportion of their income in indirect taxes like VAT, and are asked for a smaller proportion in income tax.

For richer households, the opposite is true. Because they earn more, they’re hit less hard by indirect taxes like VAT that apply to everyone in the same way. But they also pay a higher proportion of their income in income tax. This means that overall, the highest earning fifth pay a roughly average rate of tax, about 34% of their income.

The top 1% of earning households pay over a quarter of the total, about 27%, and the top 10% of earners pay over half of the total, about 59%. The top half of earners contribute about 90% of all the money that’s collected.

Bands and Rates

For most people, the first £11,000 they earn is their personal allowance and would be tax free. After that they pay the basic rate of 20p in tax on every pound they earn up to £43,000. Then they pay 40p of every pound they earn between that and £150,000, which is called the higher rate. And they pay 45p for every pound earned above this, at the additional rate. Broadly speaking, it’s the highest earning 1% who pay this rate.

There is no tax free personal allowance for those who earn over £122,000.

The amount different people pay can change when the government changes the rates for different tax bands — making people pay more or less in the pound — or it changes the threshold for tax bands, so people start paying a bigger tax rate at a lower or higher income.

Otherwise, people move into different tax bands because their incomes change. People might move into different bands as the economy passes in or out of a recession. Over time, one effect of inflation is to steadily increase the number of people paying higher rates.

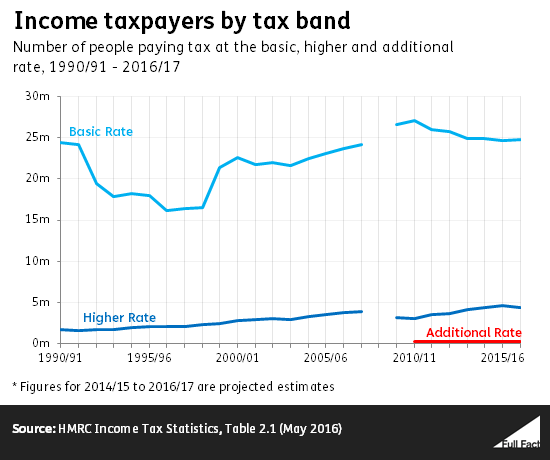

From 2009 to 2016, the number of people paying the Basic Rate fell by about 1.9 million; the number of people paying the Higher Rate of tax rose by about 1.2 million; and the number paying the additional rate has risen by about 97,000 since it was introduced in 2010.

So this year, 30 million people are expected to pay tax. About 333,000 are expected to pay the additional rate, roughly 4.4 million are expected to pay the higher rate, and 24.7 million are expected to pay the basic rate.