The Conservative and Labour parties are making similar claims about the cost of council tax, yet the results of their sums differ by over £400—how can that be?

Slightly different questions about council tax can lead to very different answers, and none seem to be perfect. Overall, we haven’t found a fair and accurate way to compare council tax costs in terms of which party runs the local authority.

It’s not always easy to work out which party is responsible for the cost of your council tax in England. In many cases you have to pay council tax to more than one body, and these can be run by different political parties. The answer can also vary a lot depending on whether you’re talking about just council tax, or the whole council tax bill (which confusingly are different things), how you measure the average cost, and the type of local authority you live in.

The Conservative Party provided us with the source of their claim, but we have been unable to replicate their calculation. We’ve asked for more detail but have not yet received a further reply. The Labour Party have not yet responded to our repeated requests, and we have not been able to replicate their calculations.

What is council tax?

Council tax is set by your local authority in order to help meet its annual budget for the year, meaning your council tax helps pay for local services.

Exactly how much you pay is based on the value of your property and the number of properties in the area which have to pay council tax, so not all households pay the same amount. Households are sorted into different bands, based on the value of their property in 1991, and the more expensive your property, the higher your council tax. Some households are entitled to reductions or exemptions.

We’re referring to the situation in England throughout this piece.

Confusingly, council tax is only one part of your total council tax bill

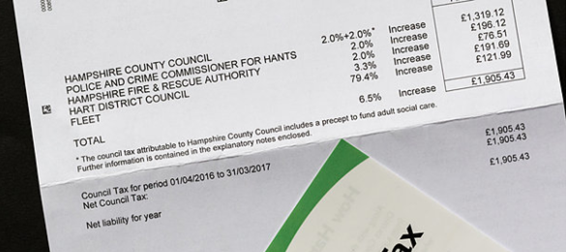

In many areas, people have to pay ‘precepts’ which fund a range of additional services like adult social care, the police commissioner, and fire and rescue services.

These precepts might be set by a different authority to the one which sets your main council tax, as the image below from two years ago illustrates.

For example someone living in Fleet, Hampshire will pay part of their overall council tax bill to Hart District Council, part of it to Hampshire County Council, part to Fleet Parish, part to the Hampshire Police and Crime Commissioner, and part to Hampshire Fire and Rescue Authority.

County councils and district councils aren’t run by the same people, so it’s possible to have some of your total council tax bill set by a Conservative-run body, whilst other parts could be set by a Labour-run body (or any other political party).

How much does council tax cost in Labour and Conservative councils?

The Conservative party told us that its calculations were based on official figures for Band D council tax in 2018/19. Based on this, it told us that Conservative-controlled councils in England charge £116 a year less than Labour-controlled councils.

We’ve not been able to replicate the calculations and have asked the Conservative party for more information, but have not yet received a further reply.

The Labour party haven’t told us where its calculations come from. In trying to replicate them we used data on “average council tax per dwelling”—which includes wider precepts. It’s not possible to pay your council tax without paying the other precepts which make up the bill. We haven’t been able to exactly replicate Labour’s sums either, and have asked for more information about this, which we have not yet received.

Linking the cost of council tax to one party is difficult

Because of the many ways you can break down the figures on council tax, it’s possible to look at the figures and come up with contradictory claims on the cost of council tax in different areas.

In attempting to replicate the Labour and Conservative sums, the main problem with any calculations we’ve tried is that your council tax might be paid to more than one body, as we’ve said already.

Using the data which the Conservative party pointed us to, you can look at the cost of council tax without precepts in England in 2018/19. But even doing this, it’s not possible to link the cost of council tax (minus precepts) to a single party in every local authority. In many areas of England only one council runs an area and sets the council tax, so there’s only one payment. But in around 200 areas there is a smaller district council and a larger county council—with the biggest chunk of council tax paid to the county council. So if we continue using the above example of Fleet, you pay council tax to both Hampshire County Council, and Hart District Council.

If you don’t include payments to the district councils, then it’s possible to make the Conservative council areas look cheaper, but this is not a complete picture of council tax, missing out payments to over 200 councils.

Different data combines all council tax payments and precepts into a single council tax cost, allowing you to look at the average total council tax bill in local authorities. Again using the Fleet example, it includes payments to the county, district, and parish councils, and the fire and police services.

If we link the total cost of a council tax bill (including all precepts) to the party running the local council (if two councils are responsible for an area, then it’s the smaller district council, not the wider county council), then using this method it is possible to make the Labour council areas look cheaper. But as we’ve already explained, these average bills include multiple payments to different bodies, so you can’t fairly compare “Labour” and “Conservative” councils this way either.

These figures are also for last year as no complete figures are available for 2018/19 yet.

There’s more than one measure of the average council tax

The Conservative party’s calculations look at the average cost of council tax for a Band D property, whereas the Labour ones seem to look at the average council tax per dwelling.

The Band D measure is better for comparing the bill for people living in similar homes in different areas, and “has historically been used as the standard for comparing council tax levels between and across local authorities.” But it may not reflect the true bills paid by residents, especially as almost two thirds of homes in England are in a cheaper bracket than Band D.

So the “per dwelling” measure gives a better impression of the actual bills paid by residents.

There could also be other factors, beyond decisions of the council, affecting the average cost of council tax in an area. Institute for Fiscal Studies research suggests that central government policy decisions can have a significant impact on local government finances. They have looked at the impact of policies on business rates, adult social care funding, and council budget funding.

There are other issues with how you crunch the numbers

It’s also not always clear which party is in control of a council. We’ve assumed that a council is run by the party which has majority control. If it’s a minority administration or a coalition, we didn’t count these. The Conservative party told us it used a similar method, but used internal party data on which party controls which council—so it could be different to ours.