Stamp duty: a drag on the housing market?

This article has now been updated. Please see below.

'Stamp duty land tax' is a tax on property. But, according to its detractors, it's a tax on much else besides - "a tax on labour mobility", "a tax on the south" and a "tax on the majority".

Originally designed as a levy on the rich to finance a 17th century war with the French, it is now a healthy earner for the Treasury, with most people paying at least 1% tax on the purchase of a property.

In its latest report using Land Registry and HMRC data, the TaxPayers' Alliance says that a quarter of home buyers are now hit with a bill of at least £7,500. These are the people buying a home valued at £250,000 or more, who are required to pay stamp duty at 3% of the property's value.

For residential property valued at up to £125,000, there's no stamp duty; for property priced between £125,000 and £250,000, you'll pay 1% of the purchase price. Over the decades, the government of the day has adjusted stamp duty bands for a variety of reasons.

After all, stamp duty (as a land tax) is a useful tool for manipulating the property market. If stamp duty rates are high, especially for first time buyers, it's likely that fewer people will be able to afford the costs of a move.

Since 2006, the 1% threshold for residential property has remained at £125,000. By not raising this sum in line with inflation, the Labour government ensured that up to the credit crunch of 2008 more properties incurred stamp duty. Similarly, the 3% band (£250,000-£500,000) has remained constant since 2000.

How is stamp duty affecting the housing market?

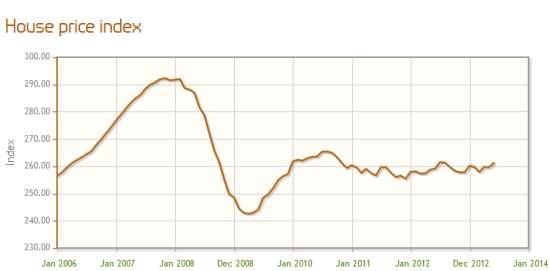

Here's what was happening to house prices before and after the housing boom of 2008, when the government collected some £6 billion in stamp duty:

During this time - the boom, the bust and now the 'recovery' - stamp duty has remained constant, although in practice more properties have become subject to it. But, from the evidence, it doesn't look like people have been put off buying property.

As we can see, since the credit crunch of 2008, the number of transactions involving 'cheaper' homes (up to £500,000) has remained more or less constant.

The situation is slightly different for the minority who are in the market for pricier properties. The number buying expensive homes, which incur higher rates of stamp duty, has fluctuated depending on changes in stamp duty.

In March 2011, the stamp duty on properties worth more than £1 million increased from 4% to 5%; in March 2012, it increased from 5% to 7% for properties worth £2 million or more. For both property bands, there were fewer transactions in the year after the rate hike.

So while HMRC has noted that stamp duty does have an impact on the number of houses bought at the upper end of the market, it's more difficult to read what impact, if any, it is having on 'cheaper' properties.

*However, the TaxPayers Alliance notes that a recent report from the London School of Economics has linked an increase in stamp duty to people being less likely to move home, especially within their local area. The report was prompted by the researchers' observation that "To date little is known about whether the stamp duty does in fact hamper mobility and if so, by how much." The report concludes that an increase in stamp duty from 1% to 3% "reduces household mobility by around 40 per cent", an effect which they described as "very substantial".

***

UPDATE (7 August 2013): The article standfirst has been amended. In place of the sentence, "Is it hitting the housing market, as the think tank suggests?", the standfirst now reads, "Is there evidence to suggest that it is hitting the housing market?" We apologise for any confusion caused by the initial phrasing. In addition, the TaxPayers' Alliance has kindly directed us to new information on evidence of a link between increased stamp duty and decreased social mobility. The inclusion of this new paragraph is marked with an asterix.

UPDATE (day of publication): This article originally said "you'll pay 1% on the amount above the £125,000 threshold." In fact, you'll pay 1% on the total purchase price.