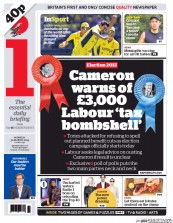

Will you pay an extra £3,000 for a Labour government?

"over £3,000 in higher taxes for every working family to pay for more welfare and out-of-control spending" — David Cameron, March 30, 2015, reported in the Express

The Conservative party began their election campaign with a claim that Labour's plans will lead to an average tax rise of £3,000 in total for every working household in Britain between 2016 and 2020. But the Conservatives make a lot of assumptions about Labour's policies that Labour hasn't confirmed.

The Conservative party began their election campaign with a claim that Labour's plans will lead to an average tax rise of £3,000 in total for every working household in Britain between 2016 and 2020. But the Conservatives make a lot of assumptions about Labour's policies that Labour hasn't confirmed.

The claims here are about forecasts, which are always uncertain: it is entirely possible the deficit will not be eliminated under the current plans.

Both Labour and the Conservatives have agreed to the fiscal mandate, which says the Treasury must aim to achieve 'current balance' in three years' time. This means that by 2017-18, the government should be forecast to spend no more than it receives, and borrow only to pay for investment if it wants to keep to this rule. George Osborne has said that £30 billion of consolidation is required to meet that target, but the figure is more like £18bn, according to the Institute for Fiscal Studies.

But the Conservatives' estimate requires a lot of assumptions. They assume that Labour will find this £30 billion in a 50:50 split between spending cuts and tax rises. This was reported in 2010, but is far from definite. The Conservatives told us they assumed £7.5 billion extra taxes in 2015-16, and £15 billion extra in the following three years.

The next assumption is even bigger: the calculations assume that those tax increases will fall directly to 'working families'—here that means households with at least one adult in work.

In other words, it assumes that Labour will not raise any tax on business.

It also assumes that they will not raise any tax that affects non-working households, including pensioners. That's everything from alcohol duty and air passenger duty to VAT and income tax.

The figure quoted by David Cameron does not attempt to look at 'the average family', instead it assumes that their estimated tax rises will affect all households equally, sharing the total equally between each of the 17 million households in the UK with at least one person working. But how much tax you pay depends on how much you earn, with different effects on different households. Given Labour's pledge to increase the top rate of income tax, it's likely that any tax increases would fall more on the rich.

It's very difficult to work out changes for the 'average' household, as we've pointed out previously, but it's fair to say that the figure of £3,028 is a very simplified estimate.

Updated (30 March 2015)

Since we wrote the article, the IFS published their own analysis of the Conservatives' figures. We have updated the article to include a link to this.