In 2017/18, around £110 billion was spent on the NHS England budget. Including things like hospitals, public health initiatives, education training and IT, the cost was £125 billion.

This is paid for mainly through general taxation, and National Insurance contributions from employees, employers and the self-employed.

General taxation funds about 80% of the budget, and National Insurance contributions cover most of the rest. Total NI contributions to the NHS in 2017/18 were estimated to be just under £24 billion, which is just under 20% of the total budget.

A small amount of cash is generated by patient charges, like those for prescriptions and dental care, which were introduced in the 1950s. In 2016/17, £555 million was charged for prescriptions in England. In total, £1.6 billion was collected in patient charges in 2016/17.

In Scotland, Wales and Northern Ireland, there are no charges for prescriptions. Health is a devolved matter, so these governments decide how much to spend on health from the block grant they receive from central government.

National insurance contributions became a much bigger part of the contribution to health spending in 2003 (from 12% in 2002 to 20%) when rates of contribution were increased to accommodate proposed increases to health spending.

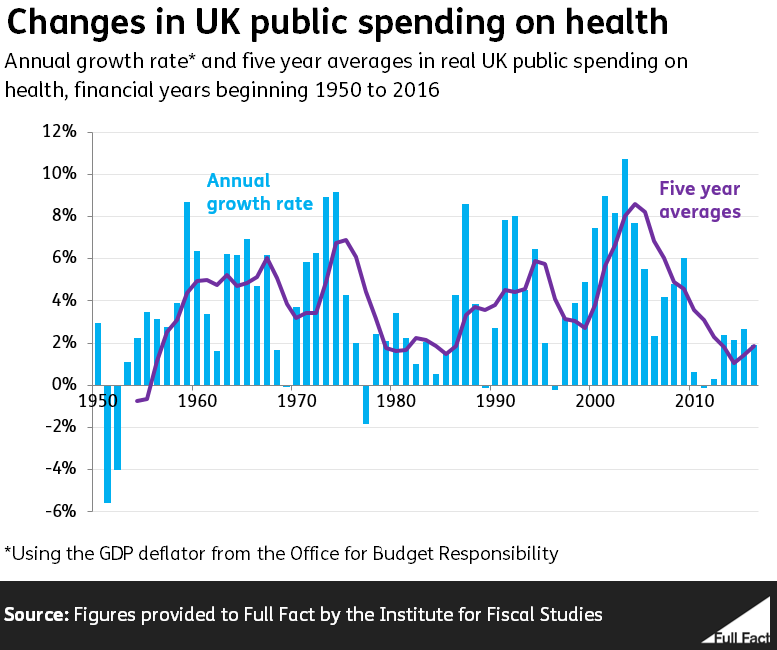

Theresa May announced recently that the NHS in England would get a real terms funding increase of just over £20 billion by 2023/24. She said this was a 3.4% annual increase, accounting for inflation.

She said part of this would come from a “Brexit dividend”, although extra money following ceasing payments to the EU are not guaranteed. She also said that “taxpayers will have to contribute a bit more in a fair and balanced way to support the NHS”, implying some of it would come from taxation. You can read more about how this increase might be funded in our factcheck.