Is Apple the most valuable company of all time?

"Apple is the most valuable firm of all time"

The Guardian, 21 August 2012

"Microsoft, however, retains the title of history's most valuable company if its 1999 peak value of about $621 billion were to be adjusted for inflation".

Reuters, 21 August 2012

"The question as to whether Apple is the most valuable company of all time — it's not the most valuable company if you allow for inflation. In fact, it's not even Microsoft. It is in fact IBM. Inflation adjusted back to 1967, IBM would be worth double what Apple is currently worth."

The Today Programme, 21 August 2012

At the close of markets yesterday, Apple's share value was the source of a veritable shockwave of excitement. The tech giant's market capitalisation value had ripened to a staggering $623.5 billion.

In the day that's followed, the media-tiger has pounced on these figures and made various claims regarding the value of Apple compared to all other company's the stock exchange has ever known. Headlines, such as that of the Guardian above and of the BBC, have labelled Apple the "most valuable company ever".

Others, such as Reuters, point out that economic inflation must be accounted for. If this is done, Microsoft during the tech bubble of 1999 would still hold the record of "most valuable company".

However, the Today Programme corrected its previous reporting of the story and qualified that neither Microsoft nor Apple stand on the top podium — the 1967 value of IBM would be double the value of Apple if inflation is accounted for. The exact figure, reported by the Telegraph, would be $1.3 trillion in today's money.

It is a confusing mess splattered with confusing terms. Full Fact gets its mop out.

Analysis

We should first clarify what all these reports mean by "most valuable". In the discussion above, a company's "value" is taken as its market capitalisation or market cap — the price of a single share in the company, times by the number of shares available.

The market cap is the market value of the company. It indicates the amount of money a comapny could expect to be sold for if it were to be put on the market.

At marker closure on Monday, Apple's shares has risen 2.6 per cent, giving it a market value of $623.5 billion (£395 billion). In these terms, Apple is the most valuable company in the world at the present time, towering above the second most valuable company right now, Exxon Mobil.

But can we really say Apple is the most valuable company of all time?

What about Microsoft?

In nominal terms, yes. Its $623.5 billion market value slides past the previous record, which, according to a Senior Index Analyst at S&P Dow Jones Indicies cited in the Wall Street Journal, has been held by Microsoft since December 1999.

Different media sources seem to quibble over the exact amount given by the S&P Dow Jones Indices for Microsoft's 1999 value, with figures ranging between $616.3 billion to $620.58 billion. But we can get a good estimation that, in 1999, floating on the dot com bubble right before it burst, Microsoft had a market cap of approximately $620 billion.

However, as the Reuters article pointed out; this new record set by Apple is only nominal in nature because it does not account for vital factor of inflation.

Economic inflation is the rise in the prices of goods and services over time. This means the value of money has effectively decreased, as the average consumer can get less for their money than they could previously.

So, according to the Bureau of Labor Statistics' inflation calculator, a consumer in 1999 holding a one dollar bill could expect to purchase the same as what a 2012 consumer could buy with $1.38.

So although Microsoft's record is less than Apple's market cap in "1999 dollars", Microsoft's market value would be much more in today's terms if we account for inflation since then. In fact, if we were to air-lift Microsoft in 1999 to the present day, its market value would stand top of the stock exchange at approximately $852.61.

As this is over $200 billion more than Apple's current market cap, labelling Apple as "the most valuable company ever" seems to be getting a little carried away.

What about IBM?

But what about the Today programme's two pennies worth? According to them, if inflation is adjusted, IBM's market value in 1967 tops even Microsoft. This would mean IBM in 1967 would hold the record for "most valuable company of all time". So would it be?

The Today programme's claims are echoed in a Telegraph article, which cites a more exact figure of 1967 IBM's market value in 2012 at $1.3 trillion.

In turn, the Telegraph sources Techcruch, a technology website. The article in question scooped its figures from Columbia Journalism Review, a US media watchdog.

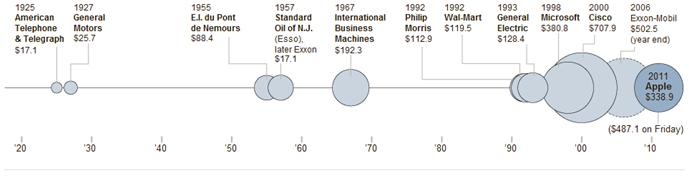

This blog calculated the present-day value of 1967 IBM from a New York Times article in February 2012. This included a graph, seen below, that measured Apple's February market value against the value of other large companies over the years.

Taking the figure of $192.3 for the IBM value in 1967, the Columbia Journalism Review adjusted the cap for inflation, valuing 1967 IBM at $1.3 trillion in today's money.

However, the NYT article had already adjusted the graph's figures to 2012 money. IBM's 1967 value is equivalent to $192.3 in 2012, not £1.3 trillion. IBM actually had a market cap of approximately $28.03 billion in 1967, according to the inflation calculator.

The Columbian Journalism Review has since spotted its mistake, and both it and the Techcrunch article have posted corrections.

Unfortunately, the Telegraph has yet to follow suit and the claims made on the Today programme cannot be unsaid. But for our purposes here, we can cross out the claim that 1967 IBM was the "most valuable company ever".

Conclusion

In investigating these confusing claims, Full Fact discovered that Apple is not the most valuable company of all time.

That record remains safely on the trophy shelf of Microsoft, which reached its market-value peak in 1999. If inflation is adjusted, the 1999 Microsoft would have a present-day market cap of over $200 billion more than Apple.

The claim that IBM holds the record for its 1967 peak market value is incorrect. A mistaken calculation made in one article sparked a domino effect of misreporting across the world's media. Microsoft's legacy remains untouched.