Chancellor warns of £12 billion in welfare cuts: where could they fall?

The graphs in this article have been updated, see changes below

As a new year begins, a familiar story has once again made the headlines: spending cuts. According to the Chancellor of the Exchequer this morning, £25 billion of them will be needed after the next election.

Three statements sum up what the Chancellor said today, taken from his Today programme interview this morning:

"We need to find a further £25 billion of cuts after the election"

"[The welfare budget] is ultimately where you can find substantial savings ... £12 billion of further welfare cuts are needed"

"If you're looking for savings in welfare, pensioner benefits is not the place that I would first turn to, I would look at Housing Benefit for the under-25s ... there are people on incomes of £60,000 or £70,000 living in council homes"

This article outlines the options future governments will have when it comes to cutting spending.

Where to cut?

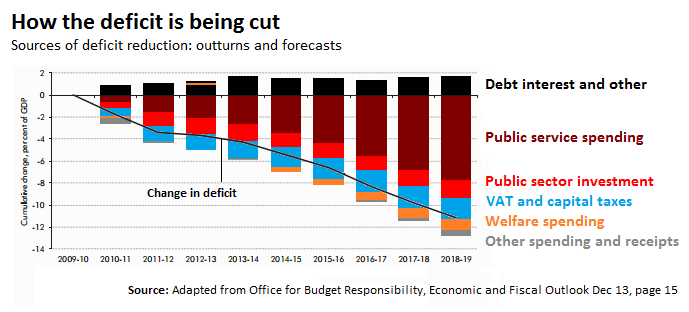

There are two ways to reduce a deficit: increase revenues or decrease spending. The Chancellor believes the government's "economic plan" can be delivered through spending cuts rather than tax rises. So far, while some tax rises have played their part, the bulk of the deficit reduction has come from spending cuts, and their role is set to grow.

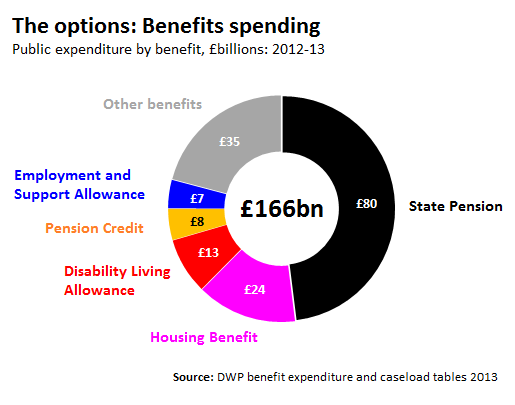

Assuming spending is the main target for savings, then, means choosing where to find £25 billion worth of savings from. The government have been clear that £12 billion needs to come from the welfare budget. Government spending on benefits makes up a large slice of the pie, totalling £166 billion in 2012-13, with tax credits making up an additional £41 billion. All that's out of £675 billion worth of spending last year.

But there comes another challenge: the government has indicated it will avoid cutting pensions. State Pensions and Pension Credit combined made up nearly £90 billion out of the £166 billion benefits budget last year. Avoiding that means working-age, family and housing benefits are likely to bear the cost.

Where that cost will fall specifically isn't yet clear. Neither the Chancellor nor the Financial Secretary to the Treasury, Sajid Javid, were more specific today than pointing to cutting Housing Benefit for the under-25s and reforms to council house occupation for high earners.

Removing Housing Benefit for people under the age of 25 would save in the region of £1.7 billion, given there are currently 350,000 claimants each taking around £94 a week. According to Paul Johnson from the Institute for Fiscal Studies, the two measures together aren't likely to fetch much in excess of £2 billion.

That leaves another £10 billion to find. Cutting fraud and error in the benefits system, which sets the government back £3.5 billion a year, would help, but it's unrealistic to think this could be completely eliminated.

While now out of date, the Institute for Fiscal Studies' Green Budget from last year gives some examples of where specific savings could be made. Freezing all benefits apart from the State Pension or Pension Credit for three years would save £3.4 billion. Making Child Benefit a part of the government's new Universal Credit would save £4.5 billion, according to the think tank.

Why not target pensions?

Economists and political commentators alike will argue over this question for some time to come. The Chancellor, however, gave one reason during his Today programme interview this morning: the government "has already made a difficult choice when it comes to welfare we provide to pensioners".

"We have increased the pension age, that has saved more money than any decision I've made as Chancellor - £500 billion for this country"

£500 billion is a whopping figure when the government only spends £675 billion a year in total. A closer look at the origin of this claim - the 2013 Autumn Statement - shows this is actually £500 billion over 50 years, so doesn't actually compare to any of the other savings figures being used either today or throughout this article.

This is more than any individual policy decision the Coalition has taken - as far as we can see - but there's another problem. It hasn't happened yet, and today's pensioners aren't the ones being affected.

As the Department for Work and Pensions (DWP) confirmed to us today, the £500 billion saving starts from 2016 and will affect those reaching state pension age towards the end of the decade but who are still of working age today.

We're still waiting for a detailed breakdown of where the £500 billion comes from, which the DWP says it will provide tomorrow.

Update (8 January 2013)

The DWP has given us more detail about the amount of savings the government expects to make from raising the state pension age:

- Bringing forward the state pension age rise to 66 (Pensions Act 2011): £30 billion saving 2016 to 2026

- Bringing forward the state pension age rise to 67 (Pensions Bill 2013/14): £70 billion saving 2026 to 2036

- Bringing forward the state pension age rise to 68 and future rises (Autumn Statement 2013): £400 billion saving 2036 to the 2060s

Unfortunately, while the government has already outlined how the previous two savings are calculated, nothing has been published about the £400 billion.

Again, not only are all the savings based on projections decades into the future (which aren't often reliable), none of them will start 'happening' until 2016, when the ongoing increases to the women's state pension age will accelerate in line with the 2011 Pensions Act.