How many green levies are there?: The effect of the government's policies on energy bills

"Since we came into government we've actually cut the number of green levies that had previously been planned by the last labour government" Chris Huhne, The Politics Show, 18 September 2011

There has been quite a bit of column space in various newspapers devoted recently to the impact that green taxes are going to have on the energy bills that consumers face, with several claiming that these policies would dramatically increase the size of these bills.

During the Liberal Democrat Conference, Energy Secretary Chris Huhne rejected such claims, insisting that the Government's policies would make consumers better off.

Not only this, but he said at the weekend that the Government had cut the number of green levies — this from a Government who said in the coalition agreement that the proportion of tax revenue raised from environmental taxes would be increased.

So what has been happening to these green levies?

Analysis

What even is a green levy? In this context it appears to be the funding of environmental policies through an increase in the prices that consumers pay for gas and electricity.

When Full Fact contacted the Department of Energy and Climate Change (DECC) in reference to Mr Huhne's claims they referred us to their own estimated impacts of various policies on Energy bills, released in conjunction with the Annual Energy Statement.

In particular they directed us towards two policies; the Carbon Capture and Storage (CCS) demonstration programme, and Renewable Heat Incentives (RHI).

The energy prices/bills document above mentions both these policies and others. However, since the publication of this document, decisions have been made about the funding of the schemes.

The 2011 budget (p.64) states: "The Government remains committed to providing public funding for CCS demonstration plants. However, consistent with its objectives for tax simpli?cation, it will not proceed with the CCS levy. It will instead fund its commitments to CCS demonstration from general taxation".

Likewise the RHI impact assessment (p.24) says of RHIs that "As announced in the 2010 Spending Review the current administration has decided against introducing...a levy"

It is instead also to be funded through general taxation. So consumers are not going to pay for these policies through levies on their bills, instead they will be paid for through other taxes, which backs up Chris Huhne's claim.

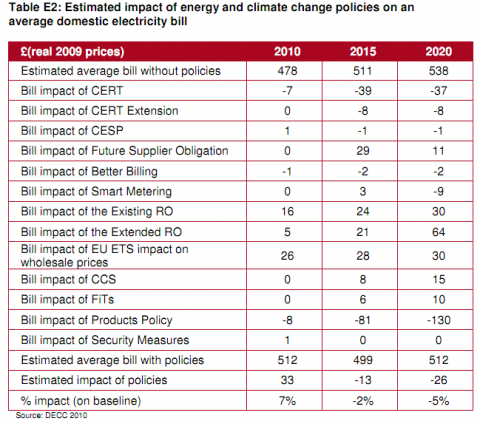

In the tables below (taken from the DECC bills/prices document) we can see that there are a number of policies that are predicted to have an effect.

It is worth noting that the DECC's estimates of the extent to which their policies will have a negative effect on energy bills have been subject to considerable criticism, notably in a leaked document written by Ben Moxham, David Cameron's energy advisor.

The DECC claims these savings come from increased energy efficiency in homes as more effective energy saving measures are taken up due to their policies. Others have claimed that the size of the savings predicted is unrealistic.

Of those policies that are predicted by the DECC itself to increase average domestic energy bills; existing renewable obligations, extended renewable obligations, EU emissions trading system, and Feed-in-Tariffs, all originate (at least in the planning stages) from before the current administration.

By looking at the above tables we can assess the second of Chris Huhne's claims, about British energy consumers being better off in 2020.

Looking at the figures in the document itself, this claim does not seem to be supported. If we accept certain assumptions about future energy prices (obviously very difficult to predict given the large fluctuations regularly seen in them) and the impact of energy saving measures, the report predicts, as can be seen below, that there will be an increase in the average domestic energy bill of 1 per cent by 2020, or £13 (in 2009 £s) — compared to what bills would have been otherwise.

This has led to doubts being raised about the veracity of Mr Huhne's claim that consumers would be better off, even on the Government's own figures.

However, this document was released before the announcement about the change in funding of CCS demonstration and RHI, as can be seen by their inclusion in the above tables.

If we discount the effects on energy bills of these measures we can make a tentative prediction, assuming the DECC is accurate in its other estimates of the effects of its policies, of the average 2020 domestic energy bill.

The estimated combined cost of CCS demonstration and RHI in the earlier table was an addition of £109 to the average 2020 domestic energy bill. Taking this amount away from this estimated average 2020 bill we get a new estimate of an average £1130 domestic energy bill in 2020 (2009 £s). This means bill would in theory be 7,8 per cent lower than without the effect of Government policies.

This suggests Mr Huhne is possibly on stronger ground than it may at first appear, although this is still dependent on definitive official estimates being produced by DECC.

Conclusion

If we accept the assumptions made by the DECC in this document there is little that can be said to gainsay Chris Huhne's claims. Two planned green levies have been cancelled, and our update of the DECC's analysis indicates that energy bills are indeed expected by the government to go down by 2020.

However the policies while not being paid for directly on energy bills, will still come out of public money.

Of course, these assumptions this prediction is based on can, and have, been questioned, and do undoubtedly involve claims about factors (e.g. energy prices) that have been highly variable in the past.

However Full Fact can do little more on this matter in the absence of another specialist analysis as a base of comparison.